Owning an electric car can seem appealing and you might be drawn in by the fact that you won’t have to pay for gasoline. However, there are some hidden costs you need to consider before you jump into a new deal. By evaluating the hidden costs of owning an electric car, you know exactly what to expect, so there are no surprises.

In this guide, we cover the average costs of owning an EV by category, including some expenses you might not have considered. In the end, we discuss whether or not you save money by driving an electric car and how long it takes to see these savings.

What Are The Hidden Costs of Owning an Electric Car?

The first hidden cost of owning an electric car is the sale price minus the incentives offered. Aside from this, you must consider the price for car insurance, maintenance, and repairs. You also have charging costs and depreciation to factor into the investment, so you can make an informed decision.

Here is some more detailed information on the hidden costs of owning an electric car:

1. Sale Price

When electric cars first hit the market, there weren’t many models that were cost-effective. However, over the past few years, EVs have become more affordable, even though they are typically higher-priced than a comparable gas-powered car.

For example, the 2022 MINI Cooper SE starts at $29,900, while the gas-powered Cooper MSRP starts at $22,900. Additionally, a 2022 Hyundai Kona Electric starts at $34,000, while the gas-powered model costs just $21,300. That’s quite a difference, one that must be considered.

However, there’s also a government incentive on EVs that you must consider. The maximum tax incentive is $7,500, but not every car will qualify. If your car is eligible, you could deduct that amount from the purchase price in your estimations, even though you are paying it upfront.

2. Car Insurance

With the higher sticker price, you can also expect to pay more on insurance premiums. The more that an insurer needs to pay out in an accident, the more you will spend on the policy. Additionally, the insurance company knows that EV parts aren’t easy to get and they can cost more to work on, so those expenses are factored into your premiums.

Depending on what type of car you are driving, you might spend twenty percent or more on insurance premiums. However, you can get a free quote from companies before you purchase the car, so you know exactly what you are looking at before you make a commitment.

3. Maintenance/Repairs

Overall, the EV is going to be cheaper to maintain than the gas-powered car. With fewer moving components, there’s less to service. Oil changes and tune-ups also don’t happen with EVs, so these maintenance appointments aren’t needed. Still, you will have some appointments to keep, such as suspension checks, tire replacement and brake checks.

Repairs are another thing to consider. While you should face fewer repairs with the EV, the bill could be higher. It’s difficult to find some of the components and the mechanics to work on the car. Because of this, you will pay a premium for any repairs.

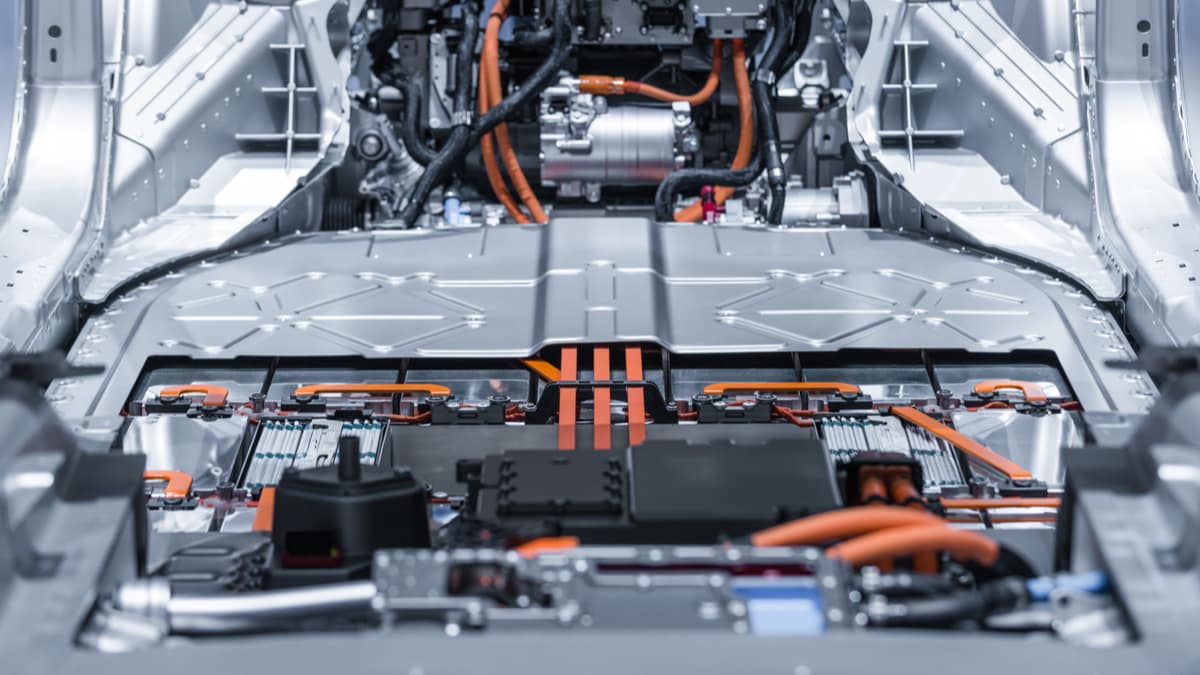

Additionally, you must consider the cost of replacing batteries. New EVs have a battery warranty that is at least 8-year/100,000 miles, so you don’t have a lot to think about if you plan to get rid of your car before that time. If you need to replace the EV battery, you could spend anywhere from $5,000 to $15,000 or more. If you prefer to lease an EV battery, the cost might be $50 to $150 per month.

4. Charging Costs

You aren’t paying for gas with an EV, but you still need electricity to keep the vehicle running. If you visit a public charging station, you might spend $0.25-$0.65 kWh to charge the battery. You can find some charging stations that are free, but others can be pricey, especially if it is in a convenient location. You must also factor in the time to charge at a public station. Instead of filling up the tank in five minutes, you need to wait thirty minutes or longer to get a full EV charge.

It’s much cheaper to charge your vehicle at home overnight. However, this method requires that you install the equipment needed to get the EV charged. The cost depends on what type of charger you install and what home modifications need to be made to accommodate the equipment. Level 1 charging stations might cost $250 to $750, plus installation, while the Level 2 charger could be $500 to $2,000, plus extra for the installation.

Once the home charger is installed, you need to think about the cost of electricity. The average nationwide price is around $0.15 kWh, but this depends on what part of the country you live in. If you charge at home every night, you might spend another $40 to $75 on your electric bill each month. This should turn out to be far less than what you would spend on gasoline.

RELATED: How Long Does it Take to Charge a Tesla? (120v, 240v & 480v)

5. Depreciation

Unlike the gas vehicle, your EV is going to drop much faster in value. On average, the resale value of an EV might be lower than 40% of its original value when a comparable used car could be sold for 50-70% of the original value.

The difference in value comes down to the battery. Customers know that as the car ages, the time to replace the battery is coming near. As we discussed earlier, this expense can be quite high, taking a big chunk of change out of your savings. The resale value is also lower because the demand isn’t as high as with a gas-powered car.

Do You Save Money With an Electric Car?

If you are looking to buy an EV to save money, you might be surprised to see all these expenses you hadn’t thought about. Whether you didn’t factor in the higher insurance premiums or the electricity cost, there can be bills down the road you aren’t prepared for. Additionally, the higher cost of buying the EV can be a shocker, sometimes costing several thousand more than a comparable gas car.

So, why do people feel that EVs help to save money? The truth is, there are plenty of ways to save by driving an electric vehicle. For one, you won’t have to worry about stopping at gas stations and filling up the tank, which is a good thing when prices are on the rise. Additionally, there will be far less maintenance than with a gas engine. If you factor in any tax credits and incentives from the manufacturer, you can also get the purchase price down significantly.

With all of these factors at play, it’s easy to save money by driving an EV. However, the cost savings aren’t going to pay off until further into your ownership. For this reason, you don’t want to buy an EV for short-term use. The only way to make it pay off is to own the car for a minimum of a few years. In addition, you can know that you are doing good for the environment, which is the main purpose of driving an EV, to begin with.

Categories: Electric Vehicles